1. Introduction

Saudi Arabia is rapidly emerging as a powerhouse in the global startup ecosystem, driven by its ambitious Vision 2030 initiative. As the largest economy in the MENA region, with a GDP exceeding $1 trillion Trading Economics, the Kingdom offers startups unparalleled opportunities to grow, scale, and access diverse markets. Its young, tech-savvy population and rising demand for innovative solutions make Saudi Arabia an attractive launchpad for entrepreneurs.

Beyond its domestic potential, Saudi Arabia’s strategic trade agreements and geographic position as a gateway between Europe, Asia, and Africa amplify its appeal. Partnerships through GCC trade agreements and growing ties with global markets enable startups to expand regionally and internationally with ease. Coupled with a burgeoning venture capital ecosystem and a focus on acquiring cutting-edge technologies, Saudi Arabia is not just fostering innovation—it is transforming itself into a global hub for entrepreneurship.

This blog delves into the Kingdom’s vibrant venture capital landscape, strategic startup acquisitions, and the market forces shaping its journey toward becoming a global leader in innovation and economic diversification.

2. Venture Capital in Saudi Arabia: A Foundation for Growth

Saudi Arabia’s venture capital (VC) ecosystem has evolved into one of the most dynamic in the MENA region, serving as a cornerstone of the Kingdom’s Vision 2030. Over the years, the country has demonstrated remarkable resilience and adaptability, leveraging capital investments to diversify its economy and drive innovation. The most recent data offers insights into this sustained growth trajectory.

Funding Evolution: Growth and Maturity

The Kingdom’s VC market has experienced consistent growth over the past few years, reflecting its increasing prominence in the global investment landscape:

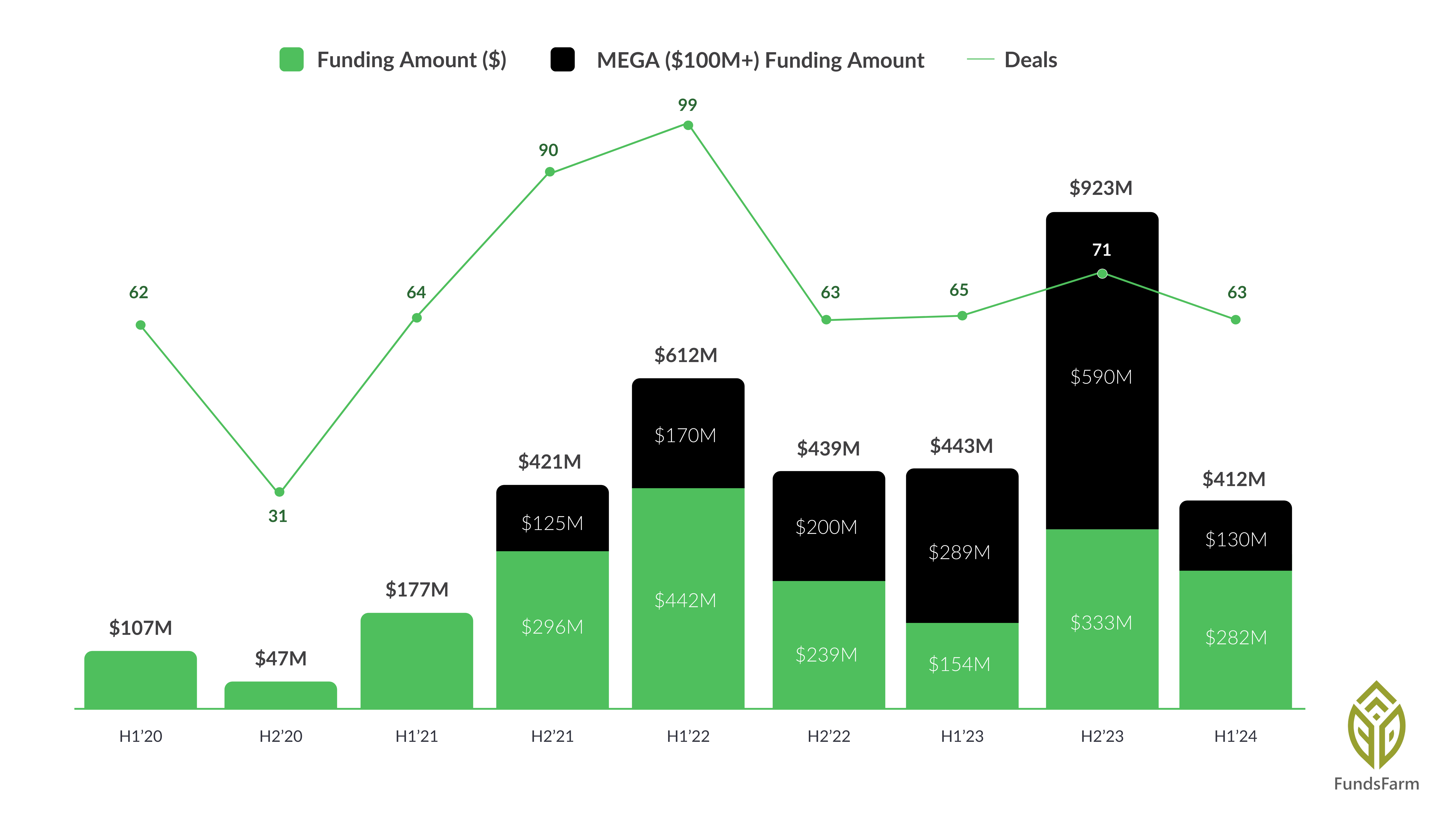

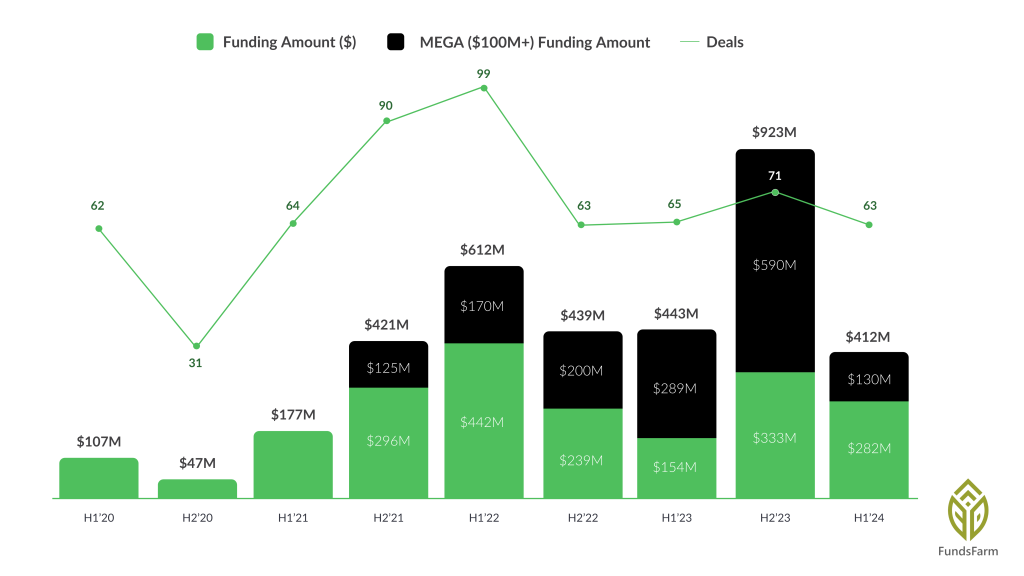

- Funding Peaks: Saudi Arabia’s venture capital funding grew steadily between H1 2020 and H1 2023, reaching an all-time high of $923M across 71 deals in H1 2023. This growth was fueled by mega-deals ($100M+), reflecting strong investor confidence and the Kingdom’s ability to attract large-scale investments.

- Sustained Activity: While H1 2024 funding amounted to $412M across 63 deals, lower than the previous year’s peak, it demonstrated resilience through a notable 83% increase in non-mega deal funding. This shift underscores the ecosystem’s maturity, with a broader distribution of capital across smaller, high-potential startups.

Sectoral Trends: Strategic Priorities Emerging

Saudi Arabia’s VC investments have mirrored its economic transformation goals, with funding consistently concentrated in sectors aligned with Vision 2030:

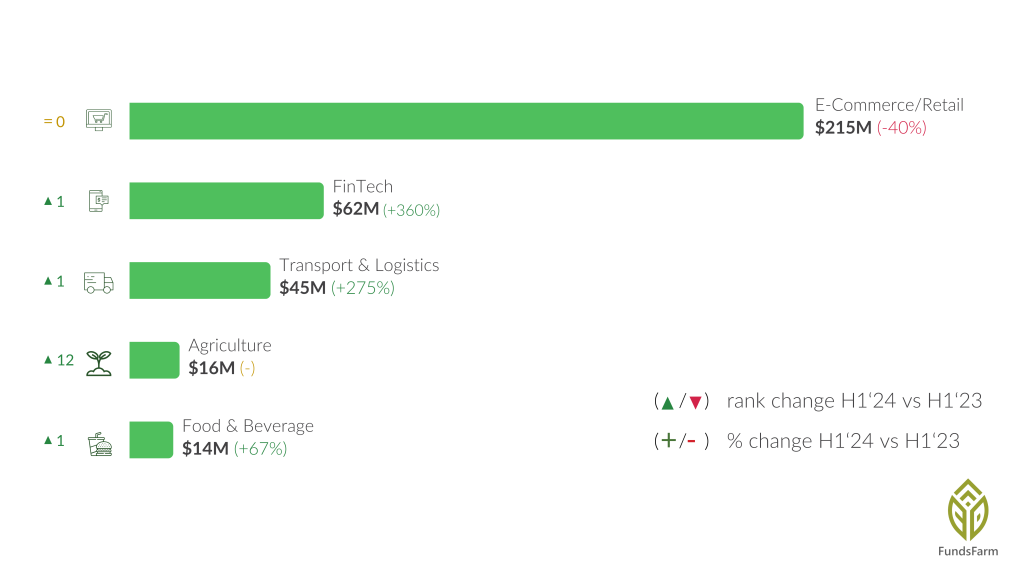

1. E-Commerce/Retail:

- As a dominant sector, E-Commerce has attracted significant funding over the years, including $215M in H1 2024, accounting for 52% of total funding. While recent figures indicate a 40% YoY decline, this reflects a natural progression as the sector matures and stabilizes.

2. FinTech:

- FinTech has emerged as a star performer, growing 360% YoY in H1 2024 to reach $62M. The sector’s consistent rise reflects increasing demand for digital payment solutions and financial services, positioning it as a critical driver of economic digitization.

3. Transport & Logistics:

- With $45M raised (+275% YoY) in H1 2024, this sector’s growth highlights Saudi Arabia’s strategic focus on improving infrastructure and supply chain efficiency to support regional and global trade.

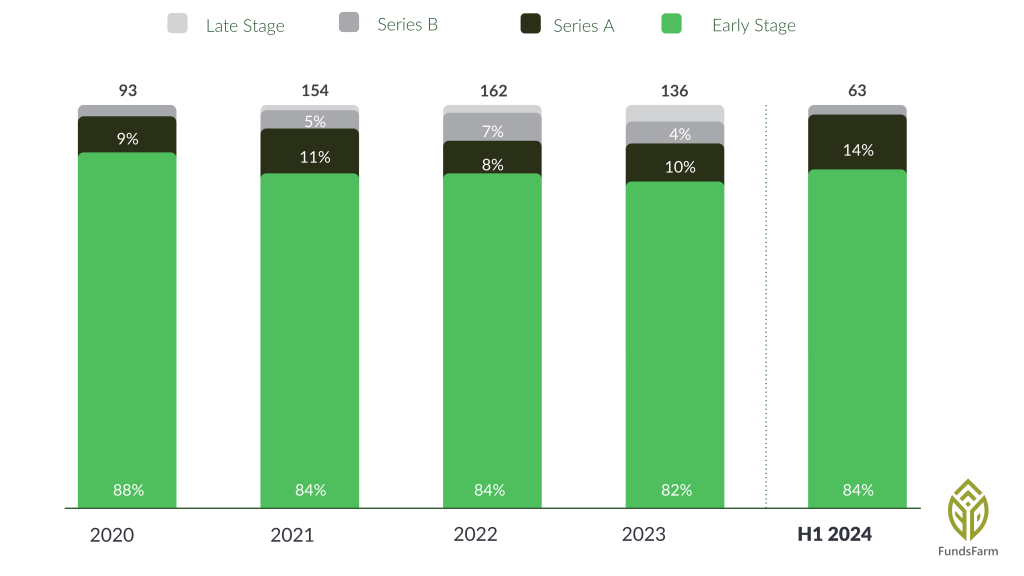

Early-Stage Investments: Building the Pipeline

- Saudi Arabia’s VC ecosystem is heavily skewed toward early-stage investments, which accounted for 84% of all deals in 2024. This sustained focus on early-stage startups demonstrates the Kingdom’s commitment to fostering innovation at the grassroots level and ensuring a robust pipeline of future growth ventures.

- The rise in Series A deals to 14% of transactions marks a critical inflection point, indicating that more startups are maturing and scaling within the ecosystem.

Leveraging Trade Agreements for Growth

Saudi Arabia’s strategic trade agreements amplify the impact of venture capital funding by enabling startups to expand beyond its borders:

- GCC Economic Integration: Membership in the Gulf Cooperation Council (GCC) offers startups seamless access to neighboring markets, creating a customer base of over 57 million people with reduced trade barriers.

- Global Trade Partnerships: Increasing collaborations with countries in Europe, Asia, and Africa enhance startups’ ability to scale internationally. This is further bolstered by Saudi Arabia’s participation in initiatives like the Greater Arab Free Trade Area (GAFTA).

A Decade of Progress: Big Picture Insights

Saudi Arabia’s VC ecosystem has transformed significantly over the past decade. From limited activity in 2010 to leading the MENA region in funding by 2023, the Kingdom has evolved into a vibrant hub for entrepreneurs and investors. Key factors behind this growth include:

- Policy Support: Government-backed entities like the Saudi Venture Capital Company (SVC) and the Public Investment Fund (PIF) have provided essential co-investment programs and strategic funding.

- Sectoral Focus: Investments have been strategically aligned with Vision 2030 priorities, driving growth in FinTech, E-commerce, logistics, and technology.

- Global Appeal: Saudi Arabia’s geographic position, combined with regulatory reforms and incentives, has made it a magnet for international investors and startups.

While global VC markets faced headwinds in recent years, Saudi Arabia’s continued growth reflects its strategic vision and ability to adapt. By balancing mega-deals with smaller-scale investments and focusing on strategic sectors, the Kingdom is setting the stage for long-term economic resilience and innovation.

For detailed data, explore the full H1 2024 Saudi Arabia Venture Capital Report.

3. Saudi Arabia’s Startup Acquisitions: A Strategic Play

Saudi Arabia’s focus on startup acquisitions has solidified its position as a key player in the global innovation ecosystem. While the numbers reveal steady activity over the years, the Kingdom’s acquisitions reflect a deeper, strategic intent to align with Vision 2030’s ambitions of economic diversification and technological leadership.

Acquisition Landscape: Key Numbers

- As of November 2024, Saudi Arabia recorded 136 startup acquisitions and 241 initial public offerings (IPOs), signaling a maturing ecosystem that blends domestic consolidation with global aspirations (Tracxn).

- September 2024 alone saw startups in Saudi Arabia attracting $170.8 million across 23 deals, accounting for 60% of total MENA funding in that month (Arab News).

Key Players Driving Acquisitions

- Public Investment Fund (PIF): PIF has led Saudi Arabia’s charge in acquiring cutting-edge companies, focusing on technology and sustainability.

- Notable deals include:

- A $1 billion investment in Lucid Motors, maintaining a 60% stake in the U.S.-based electric vehicle maker (Barron’s).

- A $750 million investment in Magic Leap, a leader in augmented reality, reinforcing PIF’s commitment to innovative technologies (Business Insider).

- Notable deals include:

- Local Entities: Companies like Jadwa Investment and Saudi Arabian Military Industries (SAMI) have also played a key role in acquiring domestic startups, focusing on sectors like education, defense, and industrial development.

Sectoral Trends in Acquisitions

Saudi Arabia’s acquisitions are not random; they are part of a broader strategy to strengthen specific industries:

- Technology and Infrastructure: Investments in telecom and IT infrastructure have been pivotal, with acquisitions like TAWAL (telecom infrastructure) and Elm (digital solutions) leading the charge.

- Sustainability and Green Tech: Deals like the stake in Lucid Motors emphasize the Kingdom’s focus on renewable energy and sustainable technologies.

- Education and Health: By acquiring firms in education and health tech, Saudi Arabia aligns its investments with the growing need for skilled human capital and advanced healthcare systems.

Strategic Impact

Saudi Arabia’s acquisition strategy reflects a twofold objective:

- Domestic Empowerment: Strengthening local ecosystems by acquiring and scaling homegrown startups.

- Global Integration: Leveraging international acquisitions to bring in cutting-edge technologies and expertise.

These acquisitions not only address domestic challenges but also position Saudi Arabia as a global innovation hub, capable of shaping emerging markets and industries. The proactive investment in startups, both at home and abroad, is a testament to the Kingdom’s ambition to lead in areas like sustainability, technology, and economic resilience.

For more insights into Saudi Arabia’s venture capital and acquisitions, explore this detailed report.

4. Insights from Acquisition Trends

Saudi Arabia’s startup acquisitions are a strategic tool to accelerate economic diversification and establish the Kingdom as a global innovation hub. These trends reveal a calculated approach to fostering key industries and aligning with Vision 2030’s priorities.

Strategic Sectoral Focus

Saudi acquisitions target transformative sectors such as technology, sustainability, and infrastructure. Notable deals include PIF’s stake in Lucid Motors (electric vehicles) and Magic Leap (augmented reality), highlighting a focus on future-oriented industries. Investments in telecom infrastructure providers like TAWAL showcase a commitment to strengthening foundational systems.

Dual Purpose: Domestic Growth and Global Reach

Saudi Arabia leverages acquisitions to:

- Empower Local Ecosystems: Investments in education, logistics, and health tech directly support national development.

- Integrate Global Expertise: Deals like Lucid Motors bring cutting-edge technology to Saudi industries, enhancing competitiveness.

Driving Diversification

Acquisitions are critical to reducing oil dependency. By prioritizing sectors like FinTech, digital solutions, and green energy, Saudi Arabia is laying the groundwork for a more sustainable and resilient economy.

Scaling Global Influence

PIF’s acquisitions extend beyond domestic benefits, positioning Saudi Arabia as a global player in emerging markets. This strategy not only strengthens the local economy but also boosts the Kingdom’s standing in global innovation networks.

Saudi Arabia’s acquisition trends reflect a focused and forward-looking strategy that combines domestic empowerment with global ambitions, aligning seamlessly with Vision 2030’s transformative goals.

Conclusion

Saudi Arabia’s venture capital and acquisition strategies go beyond economic growth; they are the pillars of a transformative vision reshaping the Kingdom’s role in the global economy. The strategic blend of domestic empowerment and international integration exemplifies a deliberate approach to achieving Vision 2030. By focusing on high-growth sectors such as technology, sustainability, and logistics, Saudi Arabia is crafting a diversified economic model built to withstand global uncertainties.

What truly distinguishes Saudi Arabia is its ability to leverage acquisitions and funding to scale local industries while attracting global expertise. This dual strategy has created an ecosystem where innovation not only thrives but drives meaningful change. The Kingdom’s investments are proactive and forward-looking, anticipating global trends and addressing local challenges to build a resilient economic foundation.

As this ecosystem matures, Saudi Arabia is solidifying its place as a globally competitive economy—one that nurtures startups capable of sparking transformative societal and economic impacts. The Kingdom’s dual focus on local growth and global leadership positions it as a key player in shaping the future of innovation and sustainability. Vision 2030 is more than a roadmap; it’s a bold declaration of Saudi Arabia’s ambition to redefine its economic potential and its place in the world.