Introduction

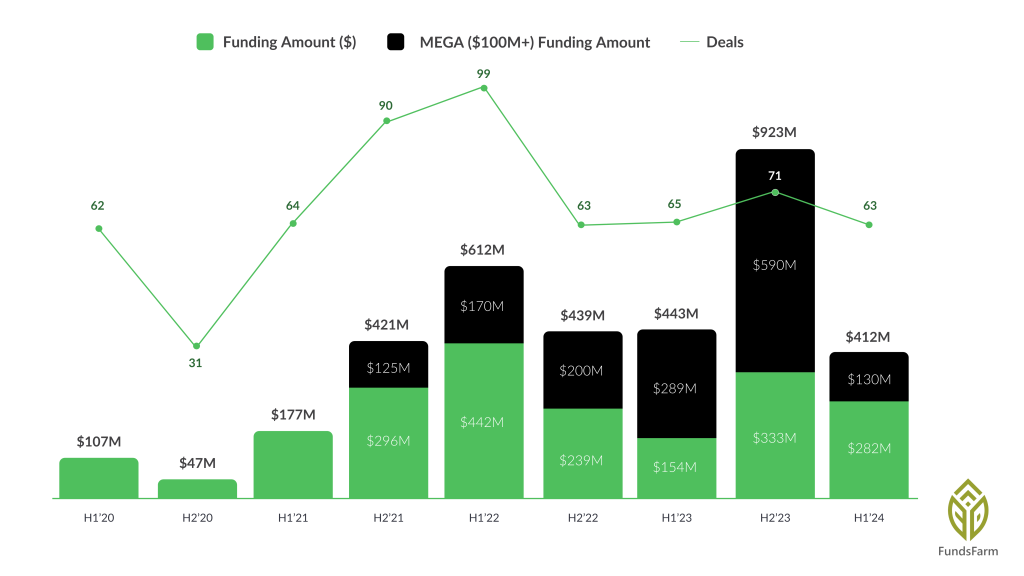

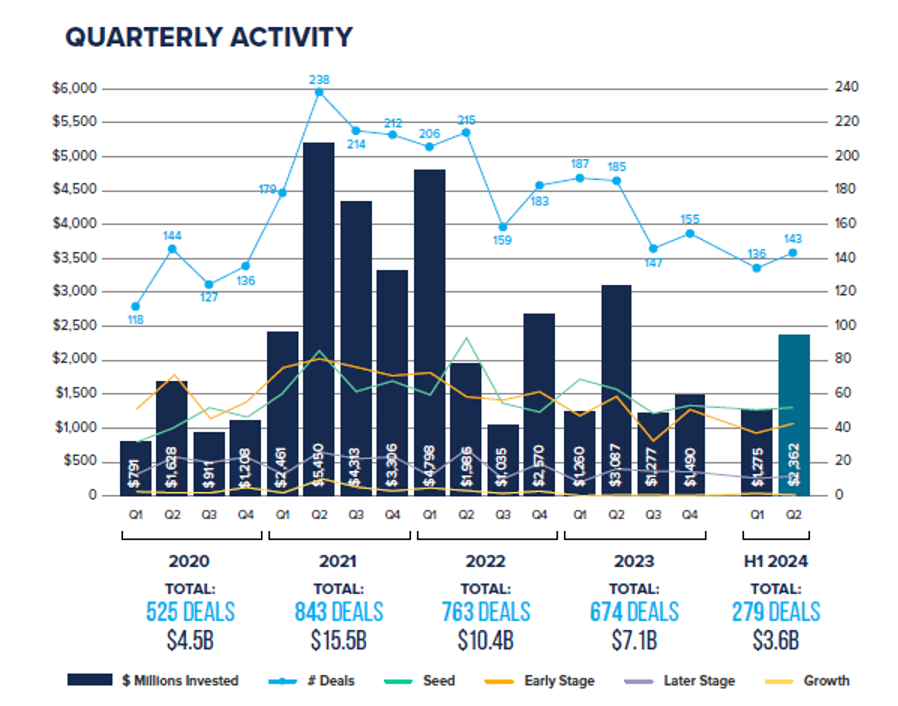

The world of venture capital is often defined by its highs and lows, and in recent years, Canada has been no stranger to dramatic shifts. After a period of explosive growth fueled by ambitious investors, the momentum in Canada’s startup scene appears to be recalibrating. Total investment, which peaked at over $15.5 billion across 843 deals in 2021, has cooled, dropping to $7.1 billion from 674 deals in 2023. But beneath the surface of these broad market movements lies an untold story—one of resilience, reinvention, and the fight for survival in one of the most competitive sectors: software.

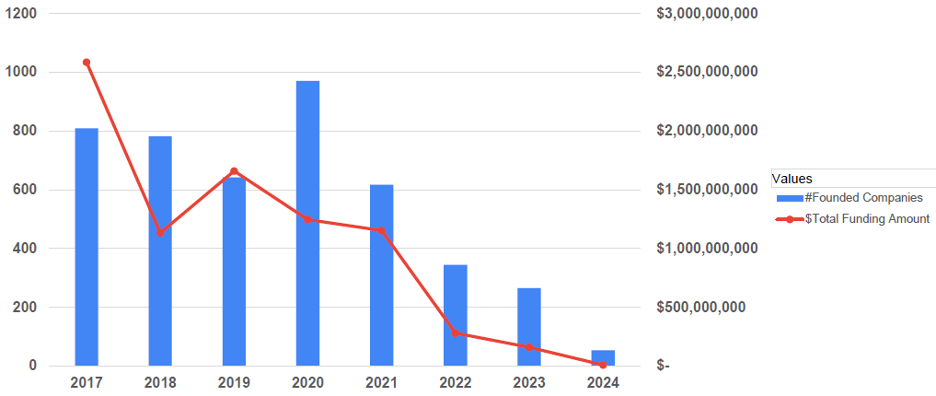

The software industry, once riding a high with over 800 new companies founded in 2020, has experienced a significant decline in both company formation and funding. By 2023, fewer than 400 software companies were founded, and total funding had plummeted to under $1 billion. As the broader market faces headwinds, one question looms large: how is Canada’s software industry navigating these changing tides? Are the startups building the next wave of artificial intelligence, data analytics, and fintech innovations thriving against the odds, or are they grappling with the same funding challenges as the rest of the ecosystem?

This blog delves into the heart of Canada’s software sector, exploring its performance within the broader context of venture capital activity in the country. By comparing the trends in software-focused companies with overall industry patterns, we aim to uncover the challenges and opportunities facing Canada’s tech ecosystem. Through this lens, we will examine whether the software industry aligns with the broader cooling trend or if it represents a unique opportunity for future growth in an increasingly competitive market.

Methodology

To provide a deeper understanding of the current Canadian venture capital landscape, this report integrates two complementary data sources: Canadian Venture Capital & Private Equity Association (CVCA) reports and Crunchbase startup data. This dual approach allows us to move beyond general market trends and dive into sector-specific and company-level insights, with a particular focus on the software industry. By combining macroeconomic patterns from CVCA with granular data on startups from Crunchbase, we can create a more nuanced analysis of how capital is being deployed and how different sectors, particularly software, are navigating the current environment.

CVCA Reports

The CVCA reports offer a broad, macro-level view of venture capital activity across all industries in Canada. These reports provide critical insights into investment trends, such as the growing dominance of mega deals, the concentration of capital in key sectors like ICT and Life Sciences, and the ongoing challenges related to early-stage funding. By grounding our analysis in these overarching trends, we can set a foundation for exploring how these factors play out in specific sectors, particularly in software.

Crunchbase Dataset

The Crunchbase data provides a granular, company-level view of the Canadian software industry and includes critical variables such as funding amounts, funding stages, company formation trends, investor participation, and acquisition data. Our analysis focuses specifically on Canadian software and technology companies founded after 2017, particularly those that have raised funding since 2020. By zeroing in on this subset, we aim to understand how the software sector is evolving in relation to the broader venture capital market.

Comparative Approach: Combining CVCA and Crunchbase Data

By integrating these two data sources, we are able to:

- Analyze sector-specific trends: Comparing the software industry’s performance with all-industry trends from CVCA allows us to see if software is following or deviating from broader patterns, especially in terms of capital concentration and sector growth.

- Highlight the impact of mega-deals: We identify how mega-deals are impacting the broader landscape versus the software sector, where smaller deals may dominate the volume but not necessarily the capital flow.

- Address early-stage funding challenges: By comparing the early-stage funding trends across industries, we can explore whether the software sector faces more significant gaps or is better positioned for growth compared to other sectors.

This combined approach allows us to go beyond general market trends and provides actionable insights into the software industry within the broader Canadian venture capital ecosystem, supported by real-world data from individual companies.

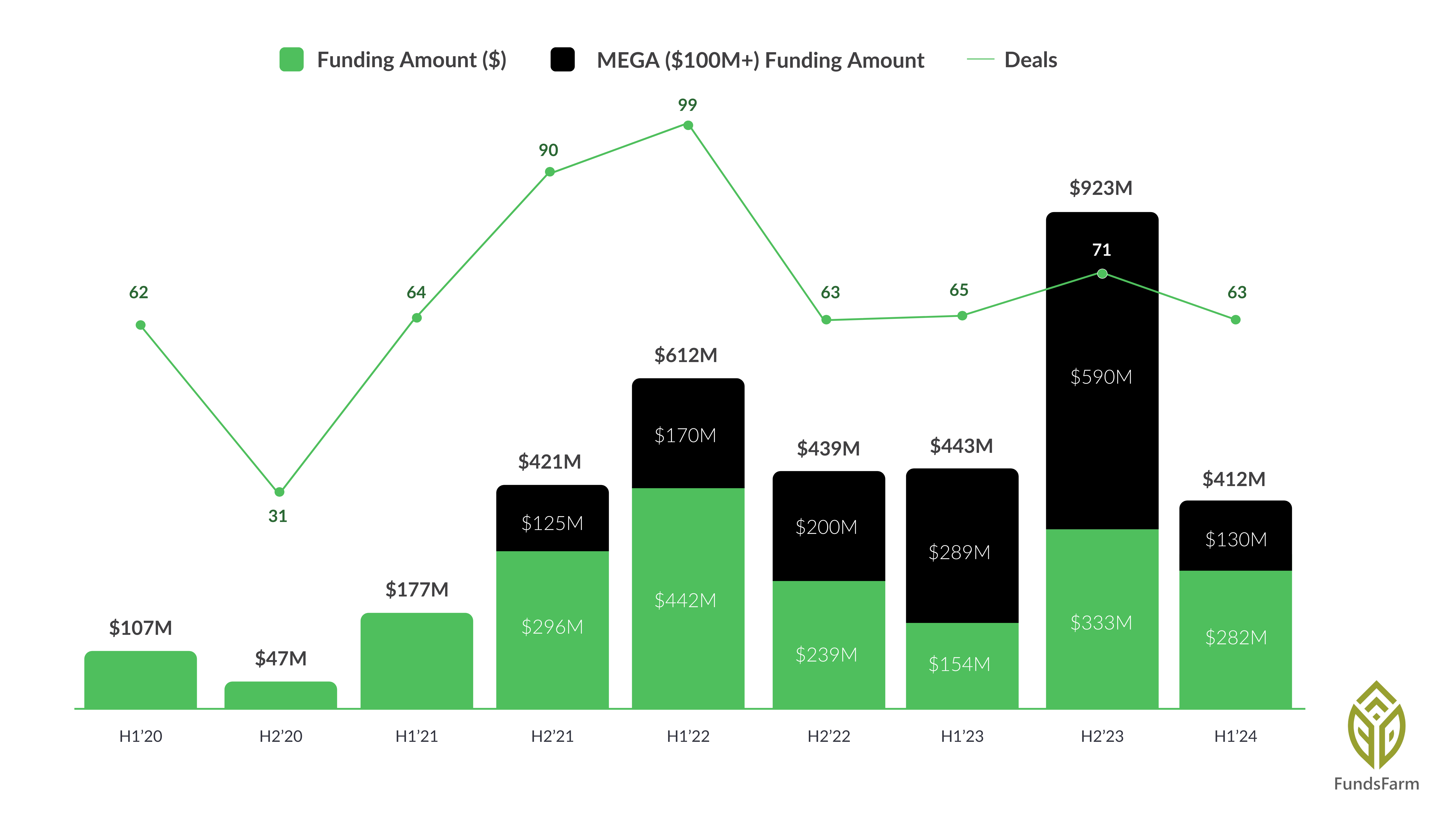

Mega Deals Dominate Funding Trends

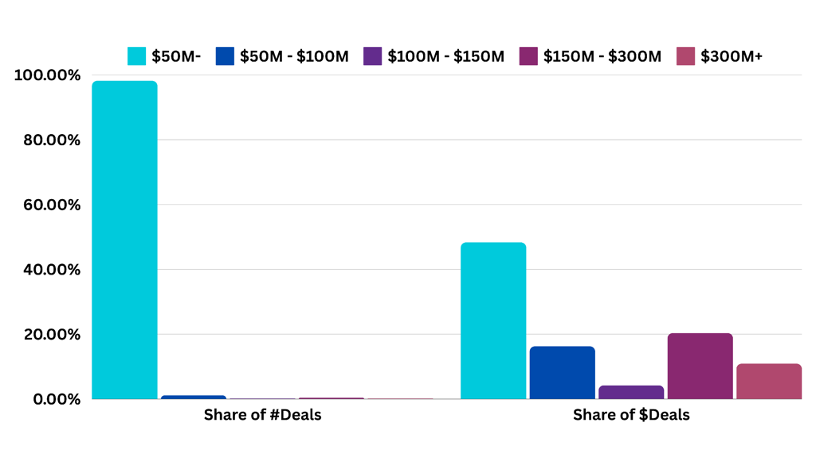

The Canadian venture capital landscape is becoming increasingly defined by mega deals, with investments exceeding $50 million now representing the majority of capital raised. According to the CVCA reports from 2023 and 2024, these large, later-stage investments account for more than 65% of the total capital deployed in recent years, signaling a significant shift in investor priorities. This trend marks a departure from the early-stage enthusiasm of previous years, as investors now seek safer bets in proven, scalable companies rather than riskier early-stage ventures.

Crunchbase data paints a similar picture of the software industry in Canada. In 2023 and 2024, 98% of all deals in the software and tech sectors were under $50M, reflecting the sheer number of smaller funding rounds. Despite this volume, these smaller deals accounted for less than half of the total capital invested. On the other hand, the 2% of deals that exceeded $50M accounted for more than 50% of the total capital raised. This disparity underscores the growing dominance of large-scale investments, where investors are making fewer but much larger bets on select companies.

This trend is particularly evident in high-growth sectors such as ICT and Life Sciences, where mega deals offer companies the capital necessary for aggressive scaling, market expansion, and product development. In the software sector specifically, companies that secure these larger rounds are able to accelerate innovation in areas like artificial intelligence, data analytics, and fintech solutions, positioning them for leadership in the market.

However, this shift towards mega deals raises important questions about the availability of capital for early-stage startups. The growing concentration of capital in later-stage companies could limit the opportunities for smaller companies, especially those in the software industry, to secure the initial rounds of funding necessary to get off the ground. This imbalance risks creating a funding bottleneck for early-stage software startups, which rely on smaller funding rounds to fuel their growth.

Over time, this trend could have significant consequences for the Canadian innovation pipeline. If capital continues to be concentrated in larger deals, the next generation of software innovators may struggle to secure the resources they need to develop and scale. This could stifle innovation across the tech ecosystem and potentially weaken Canada’s competitive edge in the global software industry.

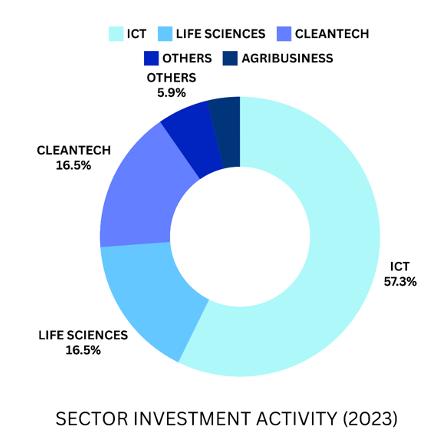

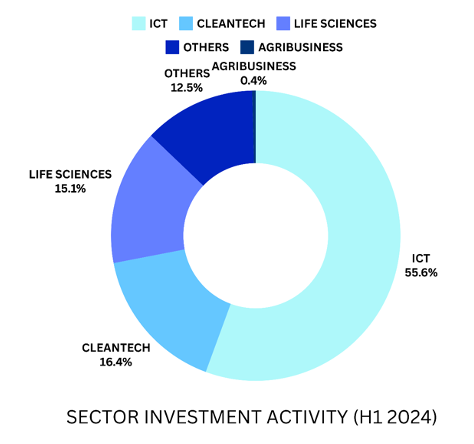

Sector Focus: ICT and Life Sciences Lead

The CVCA reports for 2023 and 2024 underscore the dominance of Information and Communication Technology (ICT) and Life Sciences as the primary recipients of venture capital investment in Canada. Among these, the ICT sector is the clear leader, driven by groundbreaking developments in Artificial Intelligence (AI), Data Analytics, and Software.

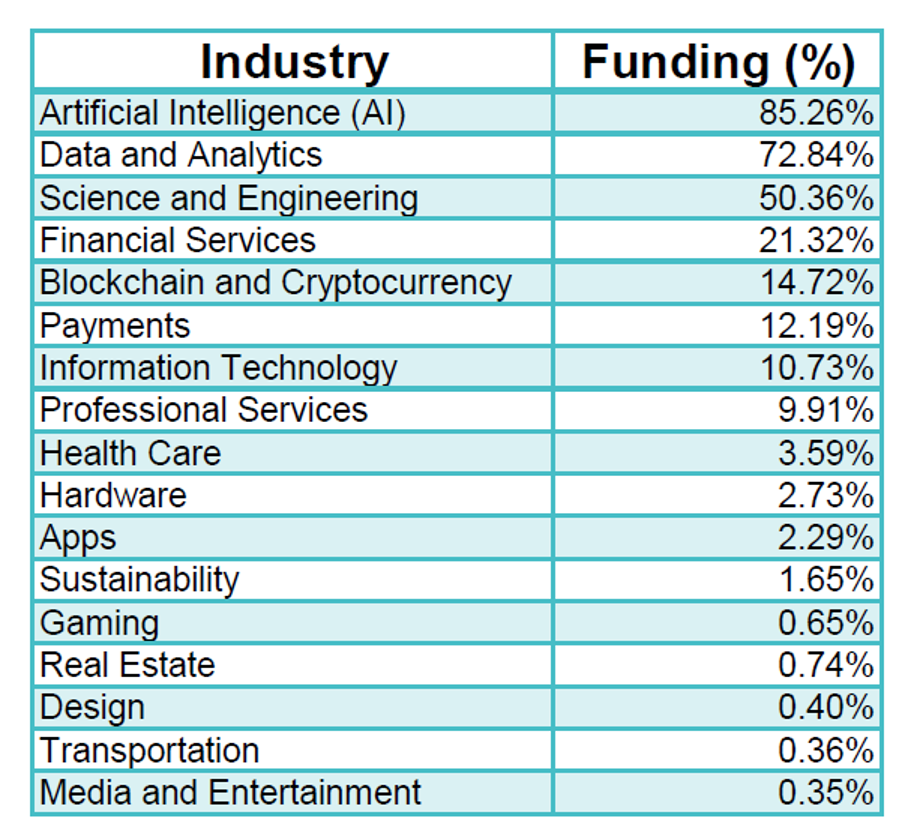

To better understand how capital is being deployed within the software industry, we analyzed the data from Crunchbase, aggregating funding across sectors that are often interconnected, such as AI, Data Analytics, and Science and Engineering. Importantly, these categories are not mutually exclusive—many companies are leveraging combinations of these technologies, meaning they appear in multiple industry groups. For example, a company developing AI-based data analytics tools will be counted in both the AI and Data Analytics categories.

With this in mind, here’s a breakdown of the top three industries:

- Artificial Intelligence (AI) accounts for 85.26% of total venture capital raised across industry groups. This high percentage reflects AI’s dominant role as a transformative technology driving innovation across numerous sectors, including automation, business intelligence, and predictive modeling. However, it’s important to note that many AI companies also fall into other categories, such as Data Analytics or Science and Engineering.

- Data and Analytics represent 72.84% of the total funding. Many companies categorized under AI also employ Data Analytics as a core component of their business model. The overlap between these categories highlights the symbiotic relationship between AI and data, where companies use machine learning to make sense of vast amounts of information, creating actionable insights for industries like healthcare, finance, and logistics.

- Science and Engineering captures 50.36% of total funding, often overlapping with AI and Data Analytics. Companies in this category focus on advanced technological solutions across multiple fields, such as biotechnology, hardware development, and software engineering. This reflects investor confidence in tech-heavy, research-driven startups capable of delivering breakthrough innovations.

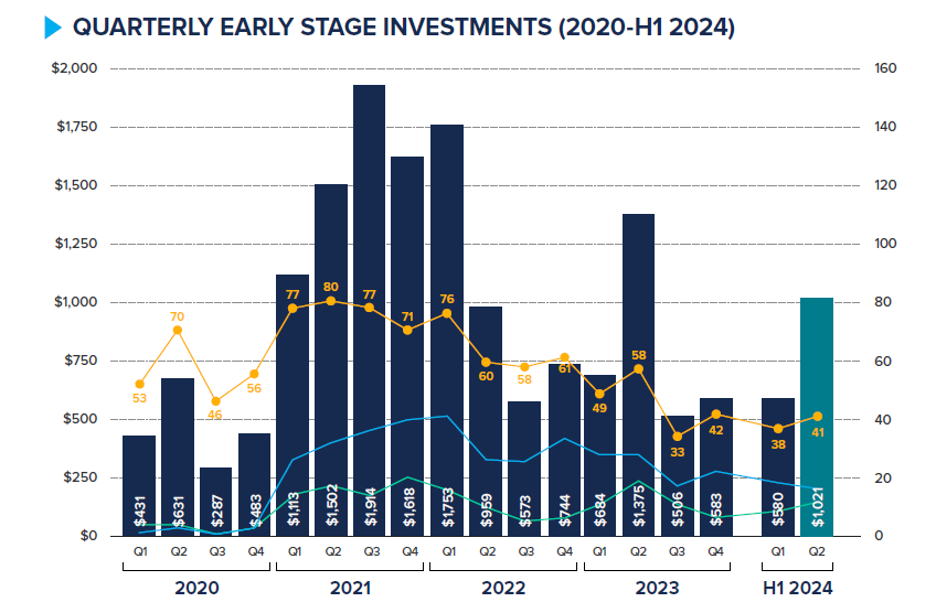

The Decline in Early-Stage Funding

The CVCA reports from 2020 to the first half of 2024 highlight a concerning decline in early-stage funding across Canada. After peaking in 2021, where early-stage investments frequently surpassed $1.5 billion per quarter, the trend shifted downward. By 2023, early-stage funding had dropped significantly, with Q2 2023 seeing only $575 million invested, one of the lowest points since the peak. A slight recovery in H1 2024, with investments rising back to $1.021 billion, has not been enough to restore confidence, particularly as the number of deals remains far below the highs of previous years.

This trend reflects a broader shift in venture capital, as investors increasingly prioritize later-stage deals and mega investments, leaving early-stage startups struggling to secure the capital they need to progress to subsequent rounds.

Software Industry Trends: A Stagnation in Growth

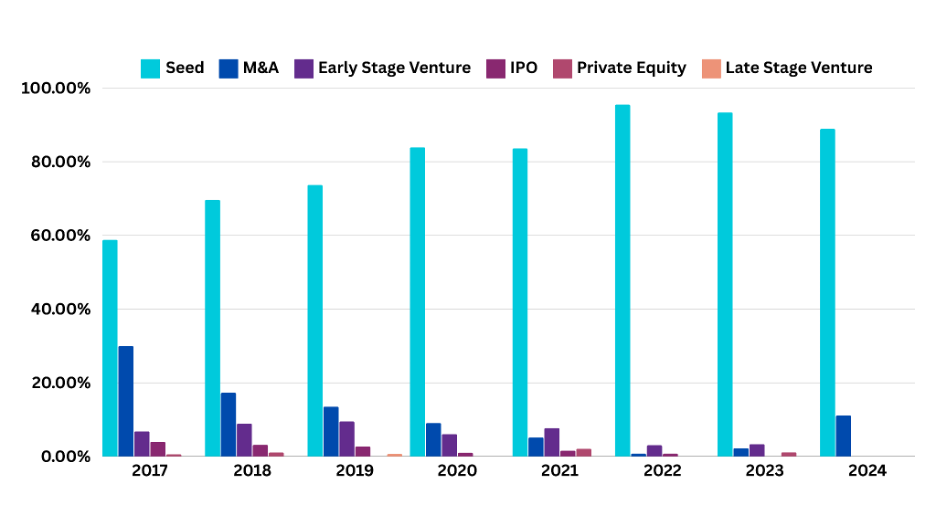

The software industry has been particularly affected by this decline in early-stage funding. Analyzing Crunchbase data for Canadian software companies founded after 2017 reveals a troubling picture: 78.79% of these companies remain stuck in the seed stage, with only 6.69% advancing to early-stage venture funding. The rest either stagnate at the seed stage or face significant hurdles in securing follow-on investments.

In comparison to the earlier momentum in 2020 and 2021, when many software startups were able to move through funding rounds more easily, 2023 and 2024 have seen little progress. The lack of growth from seed to later stages suggests that startups are facing a challenging environment, with many companies unable to raise the next rounds required for scaling.

This situation is further exacerbated by the increasing concentration of capital in mega deals, where a small number of companies secure the majority of venture capital. Meanwhile, early-stage software startups that rely on smaller rounds for initial product development, customer acquisition, and operational growth are left with fewer opportunities to raise funds, creating a bottleneck in the innovation pipeline.

Conclusion: Canada as a Hub for Research, But Falling Short on Development

The analysis of Canada’s venture capital landscape reveals a key insight: while Canada has established itself as a fertile ground for early-stage research and innovation, it struggles to support the development and scaling of its tech and software startups. The data presented throughout this blog points to a concerning stagnation in the growth trajectory of companies, particularly within the software sector.

R (Research) Thrives, But D (Development) Lags Behind

Canada has built an impressive foundation for R (research) in technology, particularly in sectors like AI and Data Analytics, which continue to attract substantial early-stage investment. This reflects the country’s strength in fostering innovation at the research phase. The robust academic institutions, research hubs, and government-backed initiatives contribute to the early success of seed-stage companies, especially in AI-driven fields.

However, Canada’s lack of a cohesive strategy for tech development is evident when startups attempt to transition from research to growth. The data shows that 78.79% of companies remain stuck at the seed stage, with very few making the leap to early-stage venture or beyond. This stagnation suggests that Canada is an excellent place to start a company but a far less ideal place to grow and scale one.

The Missing Middle: Lack of Development and Scale

The absence of a well-defined strategy for supporting D (development)—the crucial stage where companies require significant capital to commercialize their innovations and expand operations—is where Canada falls short. While mega deals dominate the funding landscape, they are largely concentrated in late-stage investments for a few select companies. This leaves a critical funding gap for companies that need to bridge the gap between seed funding and scaling capital.

Without follow-on funding, early-stage software companies are left without the resources necessary to:

- Commercialize their research-driven innovations.

- Enter global markets or significantly expand their customer base.

- Build operational infrastructure that supports growth and long-term sustainability.

This funding gap means many companies are either forced to seek investment outside of Canada, relocate to regions where growth capital is more accessible, or fail to move beyond the research phase altogether.

What Canada Needs: A National Strategy for Scaling

To address these challenges, Canada needs a national strategy that focuses not just on fostering early-stage research but also on supporting the development and commercialization of its tech innovations. This includes:

- Creating targeted funds for companies at the post-seed, early-growth stages to ensure startups can move from research to market-ready products.

- Incentivizing local venture capital to focus on scaling companies rather than prioritizing later-stage mega deals.

- Building stronger commercialization pipelines that connect academic research with market opportunities, ensuring that the innovations created in Canada stay in Canada and scale within the ecosystem.

Without these measures, Canada risks becoming a global incubator for research, where the early-stage innovation occurs locally, but the growth, development, and economic benefits are realized elsewhere. For Canada to truly thrive as a global tech hub, it must focus on bridging the gap between innovation and commercialization, ensuring that companies can scale from research-driven startups into global leaders.