Introduction

Donald Trump’s return to the U.S. presidency carries significant implications for Canada’s economy and business environment. With over 75% of Canadian exports heading to the U.S., any shift in American economic policy will undoubtedly have a ripple effect across Canadian industries. BBC

During Trump’s first term, his administration implemented protectionist measures, including tariffs on Canadian steel and aluminum, and renegotiated NAFTA into the USMCA, reshaping trade dynamics between the two nations. These policies hit critical sectors such as manufacturing, energy, and agriculture—key pillars of the Canadian economy. Global News

Now, Trump’s latest pledge to impose a 25% tariff on imports from Canada raises fresh concerns for key industries such as manufacturing, energy, and agriculture. WSJ

This development has sparked debates in Canada about how to respond to the potential fallout from Trump’s economic nationalism. For Canadian entrepreneurs, investors, and venture capitalists, the stakes are high. As trade and investment flows face renewed pressure, business leaders must prepare for possible disruptions while seeking ways to turn uncertainty into opportunity.

This article takes a closer look at Trump’s past economic policies, their impact on Canada, and what his second term could mean for cross-border trade, investment, and the future of Canadian businesses.

Trump’s Key Economic Policies (2017–2020) and Their Impact on Canada

Donald Trump’s presidency profoundly shaped Canada-U.S. economic relations, with bold policies that disrupted trade, investments, and critical industries. From tariffs to NAFTA renegotiations, these actions compelled Canadian businesses and policymakers to adapt to a rapidly shifting landscape.

2018: Steel and Aluminum Tariffs – A Trade Shock

In March 2018, President Trump imposed 25% tariffs on steel and 10% tariffs on aluminum, citing national security concerns under Section 232 of the Trade Expansion Act (BBC). As the largest supplier of these metals to the U.S., Canada bore the brunt of these measures, with exports valued at $16.6 billion CAD affected. The Canadian government responded with equivalent counter-tariffs targeting U.S. goods such as steel, aluminum, and consumer products like ketchup (CBC). These tariffs not only increased costs for manufacturers—especially in the automotive sector—but also strained bilateral relations. Analysts from the CD Howe Institute estimated a 0.2% annual GDP reduction for Canada due to these measures, underscoring the risks of economic dependency on the U.S. (Reuters).

2018–2019: NAFTA Overhauled as USMCA

Trump’s push to “fix NAFTA” culminated in the United States-Mexico-Canada Agreement (USMCA), finalized in late 2018 (BBC). The deal introduced stricter rules for trade, particularly in the automotive and dairy sectors. The auto industry faced a requirement to increase North American content in vehicles to 75%, up from 62.5%, and new wage standards were implemented for workers. These changes raised compliance costs for Canadian automakers, particularly in Ontario, without delivering significant competitive advantages. The dairy sector was also hit hard, as Canada agreed to open 3.6% of its market to U.S. producers, costing Canadian farmers an estimated $330 million annually (Global News). While the USMCA preserved access to Canada’s largest export market, the agreement’s concessions highlighted Canada’s limited bargaining power during negotiations.

2017–2020: Tax Cuts and Capital Flight

In December 2017, Trump signed the Tax Cuts and Jobs Act (TCJA) into law, slashing the U.S. corporate tax rate from 35% to 21% (BBC). The move significantly boosted the U.S.’s appeal as an investment destination, placing Canadian businesses at a disadvantage. Reports from Deloitte Canada warned of potential capital flight as investors sought better returns south of the border (CBC). To mitigate these pressures, Canada introduced accelerated depreciation measures to incentivize domestic investment, but these efforts were only partially successful. The TCJA underscored the need for Canada to remain competitive in a globalized investment landscape increasingly influenced by U.S. fiscal policies.

2018–2020: Energy Competition and Market Disruption

Trump’s deregulation of the U.S. energy sector aimed to bolster domestic fossil fuel production, creating new challenges for Canada’s oil and gas industry (Reuters). The resulting surge in U.S. oil production drove down global prices, exacerbating the Western Canada Select discount, which widened the price gap between Canadian and U.S. crude oil. For Alberta, the Keystone XL pipeline—a critical infrastructure project to transport oil to the U.S.—remained in limbo under Trump, creating further uncertainty for Canadian producers. These dynamics forced Canadian energy companies to cut costs and seek alternative markets, but global competitiveness remained elusive as U.S. production surged ahead.

2020: COVID-19 Pandemic – Economic Disruptions

The COVID-19 pandemic further strained Canada-U.S. economic relations as cross-border trade slowed sharply. Key industries such as automotive, manufacturing, and energy faced supply chain disruptions (CBC). Trump’s “America First” policies resurfaced in vaccine distribution, limiting Canada’s access to critical medical supplies and exposing the vulnerabilities of relying on the U.S. for essential goods. The pandemic highlighted Canada’s need to diversify trade partners and bolster domestic production capacity to better withstand future shocks.

Past Economic Outcomes for Canada: A Comparison with the U.S.

Trump’s policies reshaped the economic relationship between Canada and the U.S., with differing outcomes on GDP growth, unemployment, exchange rates, and key industries. While the U.S. largely benefited from domestic-focused policies, Canada faced challenges stemming from trade tensions, global disruptions, and its reliance on U.S. markets. Post-2020, these effects have persisted, with recovery trajectories diverging between the two nations.

GDP Growth: Slower Recovery for Canada

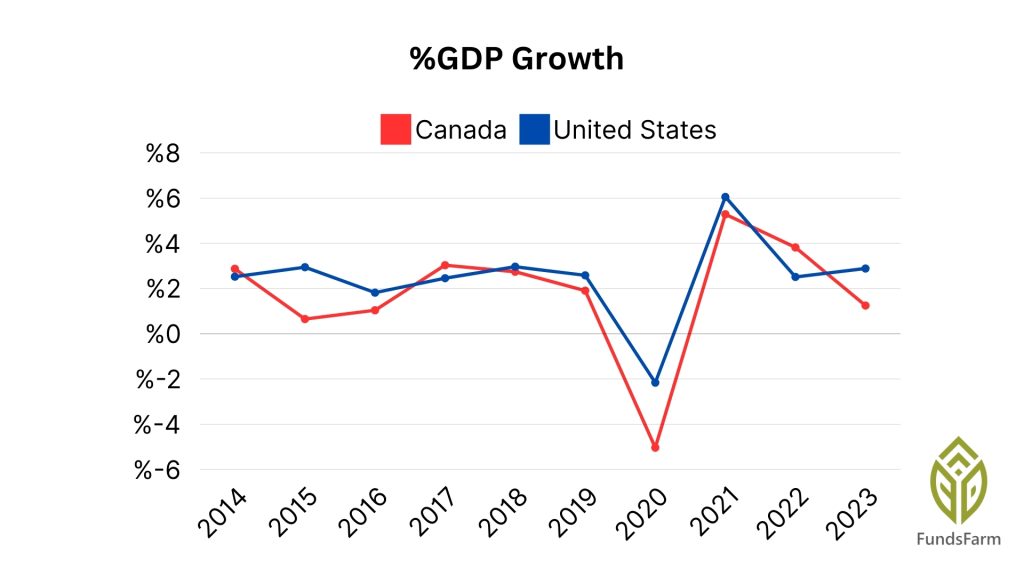

From 2017 to 2019, the U.S. maintained steady GDP growth, peaking at 2.9% in 2018 and slowing slightly to 2.3% in 2019, driven by tax reforms and strong domestic demand. Canada followed a similar trend, with growth at 2.4% in 2018 and 1.9% in 2019, though trade uncertainties weighed more heavily on its economy.

The pandemic in 2020 caused steep contractions, with Canada’s GDP shrinking by 5.4% compared to 3.4% in the U.S. The U.S. rebounded strongly in 2021, achieving 5.9% growth, while Canada’s recovery was slower, peaking at 4.5%. By 2023, U.S. growth steadied at 2.0%, while Canada slowed further to 1.4%, reflecting ongoing trade dependencies and global pressures.

The data highlights the U.S.’s stronger resilience and Canada’s challenges as a trade-reliant economy adapting to post-pandemic realities. World Bank

Investment in Canada: Shifting Patterns and Trump’s Influence

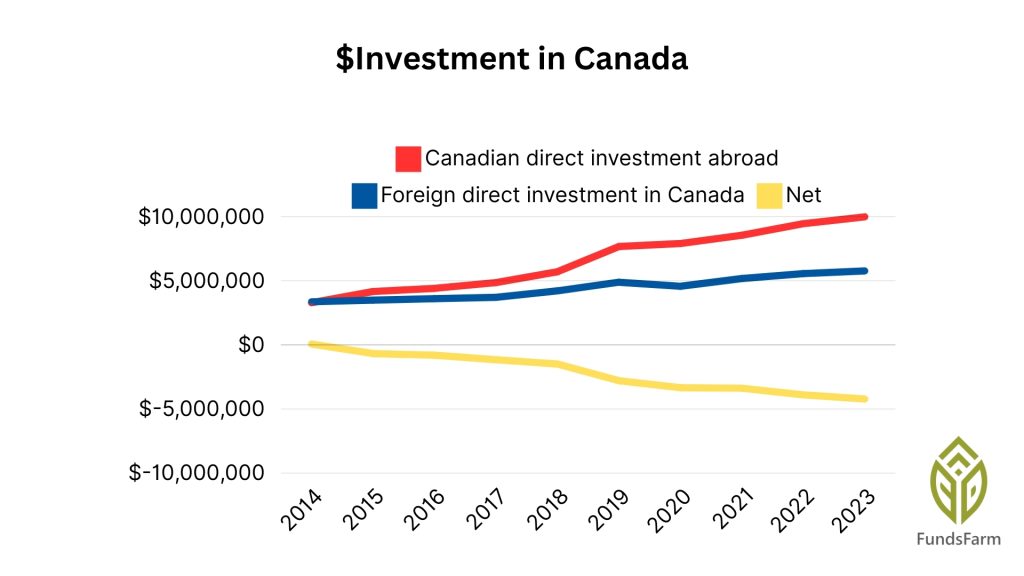

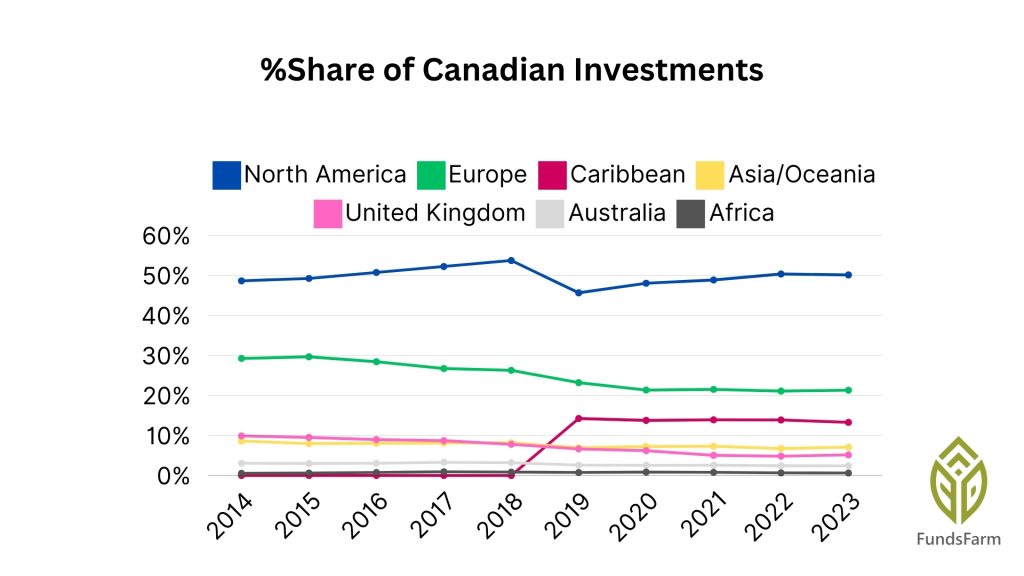

Trump’s Tax Cuts and Jobs Act (2017) reshaped global investment flows, making the U.S. a more attractive destination for investors by reducing corporate tax rates to 21%. For Canada, this change accelerated capital flight, as Canadian businesses ramped up investments abroad while foreign investments into Canada slowed. After 2018, the gap between outbound and inbound investments widened significantly, reflecting Canada’s challenges in competing with U.S. policies that favored business growth.

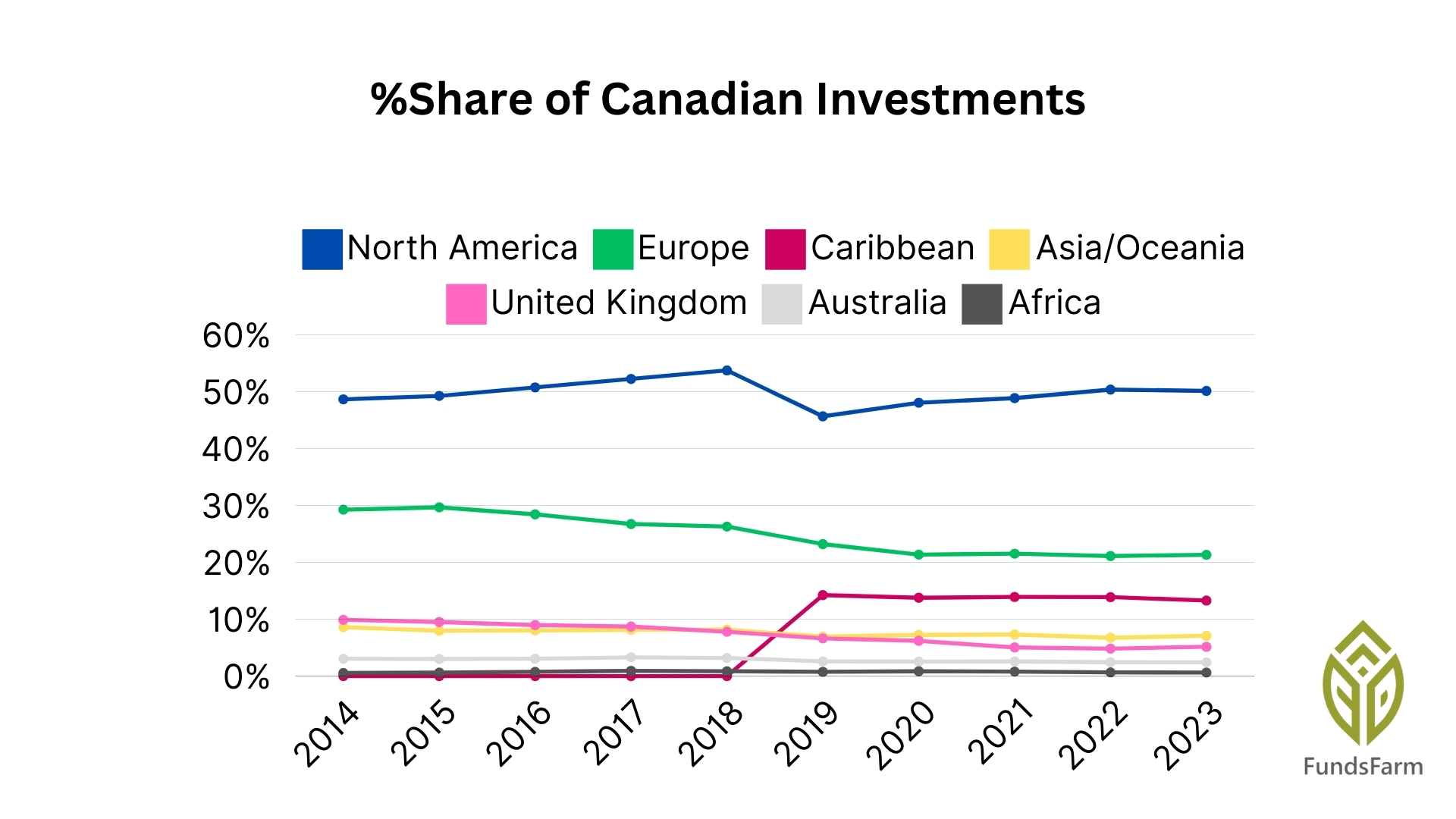

This shift also led to a notable decline in investment flows between Canada and North America. Canadian investment in North America decreased, and the U.S. became a less favorable partner for Canadian investors. At the same time, Canada redirected its focus to the Caribbean, where investment surged by 15%, capitalizing on tax-efficient opportunities and emerging markets. Meanwhile, Europe’s share of Canadian investments also declined, signaling a broader pivot away from traditional economic partners.

These trends underline the importance of strengthening Canada’s investment climate. By fostering innovation, improving competitiveness, and diversifying investment opportunities, Canada can better attract and retain the capital needed for long-term economic growth. Statistics Canada

Unemployment Rate: Pandemic Overshadows Policy Impact

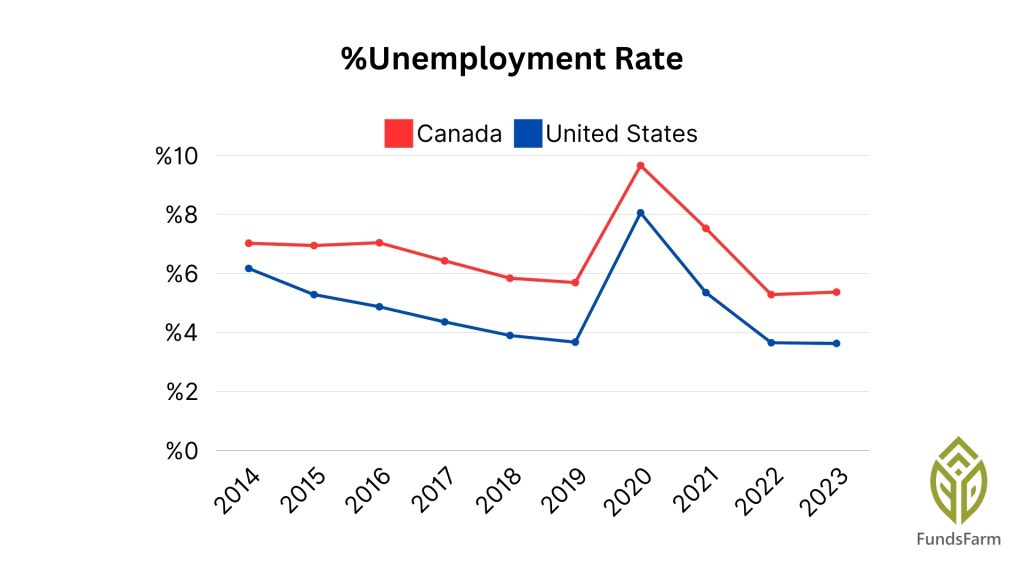

From 2017 to 2019, U.S. unemployment declined steadily, reaching 3.7% in 2019, supported by a strong economy. In Canada, unemployment also improved, dropping from 6.3% in 2017 to 5.7% in 2019, reflecting stable labor conditions despite trade tensions.

The COVID-19 pandemic in 2020 caused unemployment to spike, peaking at 8.1% in the U.S. and 9.6% in Canada, as industries faced widespread disruptions. Recovery followed different trajectories: by 2023, U.S. unemployment returned to 3.7%, while Canada stabilized at 5.3%, slightly above pre-pandemic levels.

Trump’s policies, including tariffs and trade changes, had minimal impact on unemployment rates. The pandemic’s global disruptions overshadowed policy-driven effects, with both countries demonstrating resilience despite temporary labor market shocks. Canada’s slower recovery reflected its reliance on trade-dependent sectors rather than U.S. policy outcomes. World Bank

Exchange Rates: A Long-Term Impact

The Canadian dollar (CAD) showed notable volatility during and after Trump’s presidency, largely influenced by trade tensions and global economic shifts. From $0.76 USD in 2017, the CAD weakened to $0.74 USD by 2020, reflecting pressures from U.S. tariffs and declining energy prices.

Following Trump’s presidency, the CAD experienced a sharp rebound, peaking at $0.78 USD in 2021, driven by a recovery in global commodity prices and renewed investor confidence. However, this recovery was short-lived. By 2024, the CAD steadily declined, dropping to $0.72 USD, as inflation, geopolitical instability, and weakening demand for Canadian exports weighed on its value.

Trump’s trade policies had a lasting impact on Canada’s exchange rate, with initial tariff-driven pressures creating a weaker CAD. Although the post-pandemic recovery provided temporary relief, the long-term trend highlights persistent vulnerabilities tied to Canada’s reliance on U.S. trade and commodity markets. XE

Industry-Specific Outcomes: Shifting Dynamics in Canada’s Economy

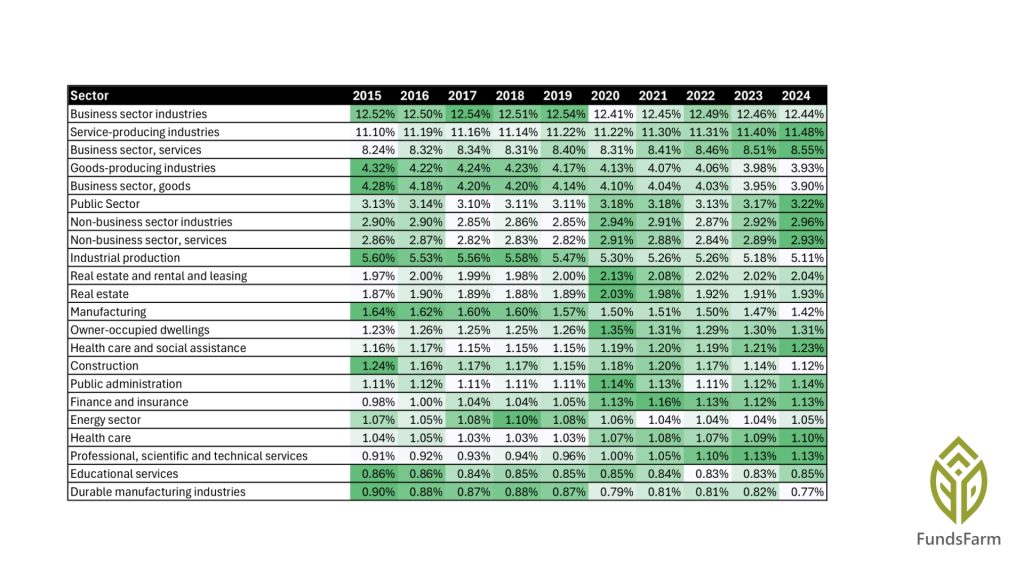

Canada’s economy has shifted towards service-oriented industries, while manufacturing and production sectors have seen a decline in GDP contribution. Analyzing the 20 largest industries, which make up over 70% of GDP, reveals the following trends:

Growth in Service-Related Industries

Service-producing industries have become the cornerstone of Canada’s economic growth, with their share of GDP rising from 11.1% in 2016 to 11.5% in 2024, marking the largest gain among all sectors. Health care and social assistance also expanded steadily, driven by increased demand and post-pandemic investments. Business services and professional, scientific, finance and insurance, and technical services have seen consistent, incremental growth, reinforcing the economy’s shift towards knowledge and service-based industries.

Decline in Manufacturing and Production

In contrast, manufacturing and production sectors have struggled to maintain their share of GDP. Industrial production experienced one of the most notable declines, falling from 2.8% in 2016 to 2.5% in 2024, reflecting challenges in global competitiveness and reduced export demand. Goods-producing industries and manufacturing also saw smaller declines, while the energy sector faced headwinds from volatile oil prices and infrastructure bottlenecks, slightly reducing its economic contribution. Statistics Canada

Conclusion

It’s difficult to attribute Canada’s economic challenges and shifts in macroeconomic KPIs solely to Trump’s actions. The economy is shaped by a complex interplay of global and domestic factors, and one of the most significant in recent years has been the unpredictable impact of the COVID-19 pandemic, which brought unprecedented disruptions to economies worldwide. While Trump-era policies—such as tariffs, trade restrictions, and corporate tax reforms—contributed to Canada’s economic shifts, they were not the sole cause of these changes.

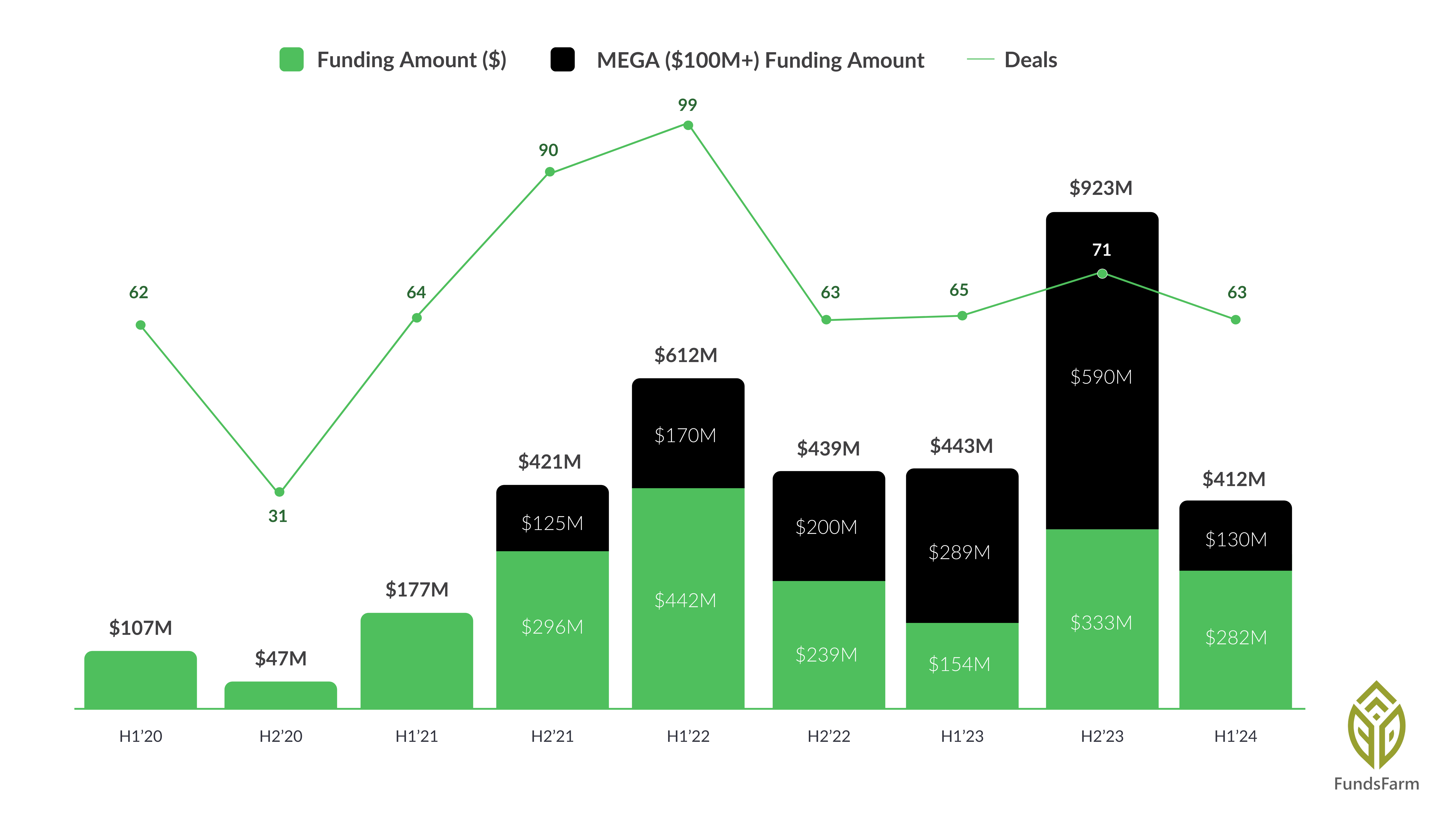

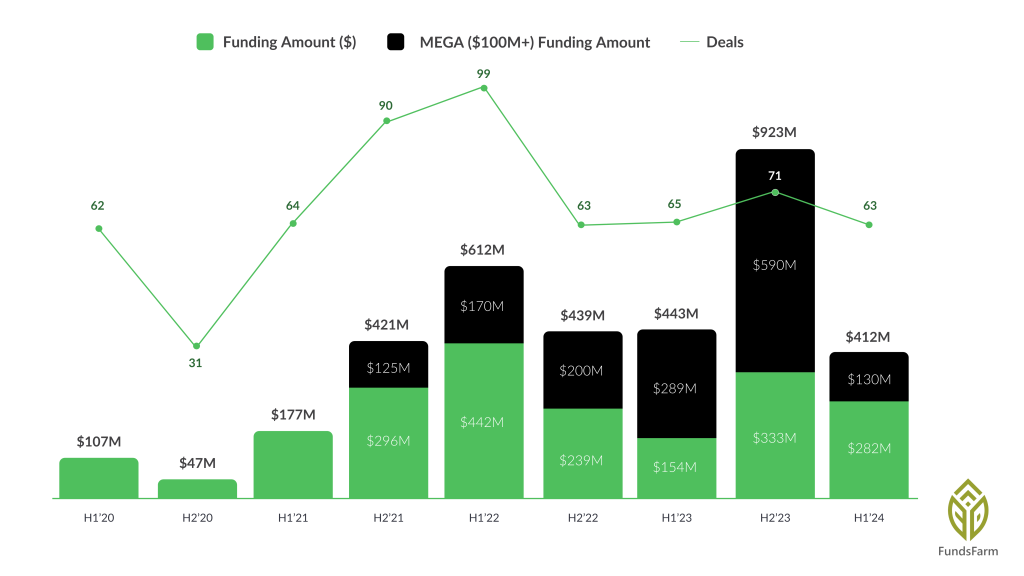

Canada’s economic growth has long been tied to its relationship with the U.S., but Trump’s policies during his first presidency disrupted this balance. If he returns to power, similar actions—like tariffs and trade restrictions—could be repeated, potentially with even harsher consequences. Last time, these disruptions shifted Canada’s economic landscape, driving a noticeable decline in goods-producing industries (e.g., manufacturing) and boosting service-producing sectors, including finance, insurance, health care, and professional services, as seen in recent data.

For startups, this shift created opportunities. Increased focus on services and innovation positioned Canada as a hub for growth in technology, health care, and professional services. Moving forward, Canadian businesses must be prepared to adapt to trade uncertainty by leveraging Canada’s CPTPP and CETA agreements to diversify markets, reduce reliance on the U.S., and capitalize on global opportunities.

For policymakers and entrepreneurs, the lesson is clear: resilience lies in innovation, trade diversification, and strengthening Canada’s service and startup sectors to navigate potential disruptions and secure sustainable growth in an unpredictable economic environment.